If I could ask for one thing, it would be to have access to good credit so I could have some breathing space. Just because you’re in poverty doesn’t mean you’re not sensible or responsible. You’re affected more by your circumstances than poor money management. You’re not silly; you just don’t have choice. Poverty has wider social implications beyond the wellbeing of one individual and their children.

I’m a single parent to my four year-old son. We live just outside Manchester, and I currently work as an NHS administrator. I was in a well-paid job when I became pregnant, but when I returned to work, everything changed. I was made redundant and forced to look for another job. I now earn around 40% of the wage I was on before I had my son. Initially, I tried to work full-time, but it just wasn’t feasible because childcare costs amounted to over £1,000 a month. It’s been so difficult to find good quality, affordable childcare near us. We have to travel to the next village, which means paying for £5 bus tickets as I can’t afford a car. I tried to take on some extra bar work in the evenings, but I couldn’t commit to more hours or routine shifts because I need someone to mind my son. Childcare is so expensive and the job pays the Minimum Wage, so it’s just not worth it. I get Working Tax Credits and Child Tax Credits, but things are still really tough financially.

I have to pay more for my home contents insurance because I can only afford monthly instalments rather than paying less overall for the year in one lump sum. I’ve been considering maybe cutting back on it, but I’m torn because it’s really important: not only is it a condition of my mortgage, but having insurance gives me a bit of certainty and security.

It’s also difficult for me to access supermarket deals. Not only do you need a car to get to the cheapest supermarkets in the first place, but also to carry large value packs of groceries home. As we live in a village, I have to shop locally, which is great for small businesses but tough on my budget! Online shops are only free if you spend way above my usual weekly spend, and discount vouchers are often only £10 off minimum spends of around £100. I’ve been thinking about cutting back even further than I already do.

I’m so aware that I’m constantly putting money into things that need to be replaced rather than repaired, but I just can’t afford to buy new things. For example, I’ve had to keep paying for my roof to be patched up on a regular basis because I can’t afford to buy a new one outright. I also have to use tradespeople who give the cheapest quote and end up doing really shoddy work. It’s the same with buying shoes or carpets – you pay less in the beginning, but have to replace the items more often. It’s a false economy, but what can I do?

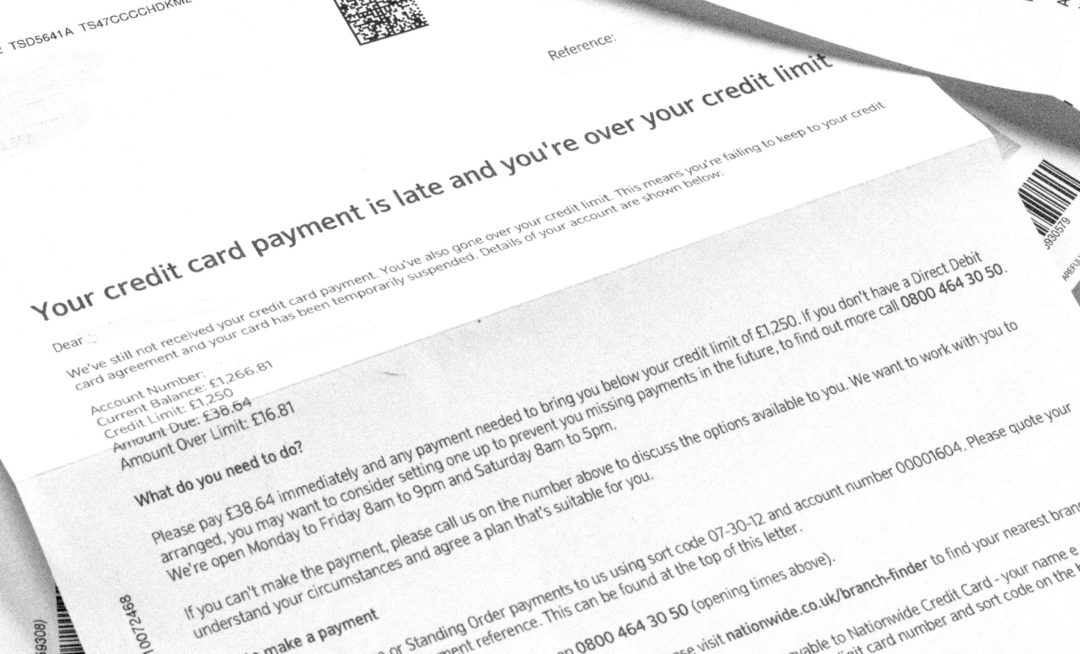

Things scare the life out of me financially now. I can’t get loans anymore, the interest-free element of my credit card has been pulled, and I have to pay huge amounts of interest on my overdraft just to keep us ticking over. I had to get further and further into my overdraft to the point where I can’t do that anymore. It feels like I have to close my eyes just to keep going.