The Resolution Foundation has today published “An outstanding balance” which looks at inequalities in the use – and burden of – consumer credit in the UK.

The report’s findings include:

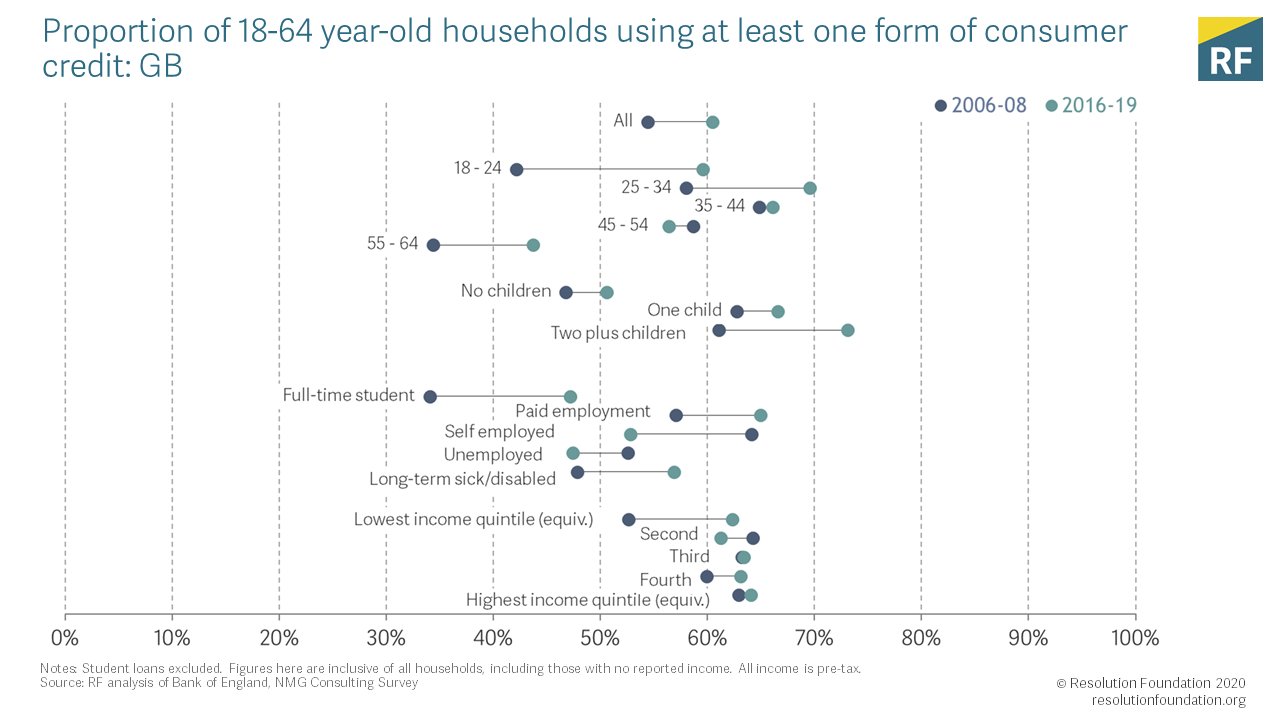

- Over the past ten years there has been a 10 percentage point rise in the proportion of lower-income households using some form of consumer credit.

- This rising consumer debt has been concentrated in products with high interest rates that have not got cheaper over the past decade – unlike mortgage debt, which low income consumers are less likely to hold, and that has from the Bank of England’s low interest rates.

- For example, there has been a 13 percentage point rise in the share of low income households using a credit card, which have an average quoted interest rate today of 20 percent – up from 15 percent in 2008.

- And despite a decade of low interest rates, the burden of debt remains substantially higher for those households at the bottom.

- For instance, debt repayments, relative to monthly pre-tax income, are nearly 3 times as high for households in the lower-income quintile, compared against their higher-income counterparts.

Carl Packman, Head of Corporate Engagement at Fair By Design, said: “”In the last 10 years, low income consumers have suffered a double financial penalty through a combination of rising living costs, and missing out on the benefits of low interest rates. This has decreased their financial resilience, and increased their exposure to paying a poverty premium, through reliance on very expensive credit products and repayments.”